South Korean Authorities Consider Over-the-Counter Crypto Regulation

South Korean regulators look set to show their consideration to the over-the-counter (OTC) crypto market, with indications regulation could possibly be on its manner.

The nation has moved to shore up its regulatory system this yr within the wake of the so-called “Terra-Luna scandal,” which left 1000’s of home LUNC buyers out of pocket.

The information has additionally been dominated by a high-profile political scandal involving token-owning lawmakers.

A number of (equally high-profile) allegations of the market manipulation of so-called “kimchi cash” have additionally rocked the nation.

However to this point, regulation has centered on centralized crypto exchanges.

Per Asia Kyungjae, “prosecutors and monetary authority officers” at the moment are “straight mentioning” the “issues of” the OTC market.

OTC merchants have been implicated with smuggling and tax evasion costs pertaining to “kimchi premium” buying and selling.

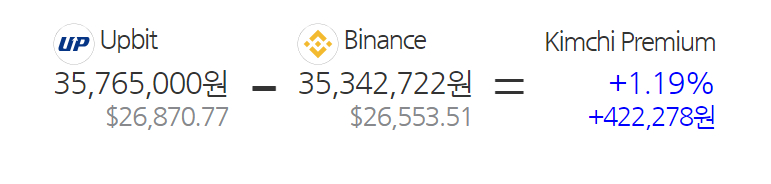

The kimchi premium is a bull market phenomenon whereby retail BTC costs rise a lot sooner in South Korea than elsewhere on the planet.

Throughout these intervals, South Korean exchanges’ BTC costs can climb to over 30% of the worldwide common.

Previously, this has seen South Korean merchants shopping for Bitcoin (BTC) from OTC merchants based mostly in nations comparable to China.

Kimchi premium merchants then swap these BTC tokens for fiat on home crypto exchanges.

The police and prosecution officers have clamped down laborious on kimchi buying and selling rings, unearthing related shell firms, unlawful semiconductor buying and selling, and valuable steel smugglers within the course of.

However the South Korean OTC market stays largely unregulated.

OTC Crypto Merchants: In South Korean Regulators’ Crosshairs?

An occasion held earlier this month on the Supreme Prosecutors’ Workplace signifies that legislation enforcers need to change that.

The occasion was titled “Authorized Challenges within the Digital Belongings Discipline” (literal translation), and noticed participation from the prosecution service.

Representatives from the Monetary Companies Fee and the Seoul Southern District Prosecutors’ Workplace Digital Asset Crime Joint Investigation Group additionally attended.

Audio system on the occasion claimed “extra” and “stronger” crypto regulation was required.

They usually claimed that OTC markets have been turning into “the epicenter of digital currency-related crimes,” comparable to “fraud and cash laundering.”

Deputy Chief Prosecutor Ki No-seong known as for regulation for “OTC firms,” explaining:

“Unlawful OTC [crypto] firms have abroad arms and are engaged within the enterprise of changing illegally obtained digital foreign money into Korean received or international foreign money. We should regulate these firms.”

Attendees known as the OTC market the “high 1% market,” claiming that it was “primarily utilized by high-value buyers.”

Some OTC marketplaces energetic in South Korea, they claimed, present “buying and selling providers for over 700 cash.”

Hong Ki-hoon, a professor of Enterprise Administration at Hongik College, mentioned,

“The investigative and monetary authorities at the moment are repeatedly sending sturdy messages in regards to the digital foreign money market. Sooner or later, I anticipate stronger [regulations] to be imposed on digital foreign money market manipulation and cash laundering.”

In February this yr, police mentioned they’d closed down a suspected worldwide OTC-kimchi premium buying and selling ring working in South Korea.

A gaggle of people, together with a Libyan and three North Korean defectors, have been charged with violations of the Particular Monetary Data Act and the International Change Transactions Act.

Prosecutors mentioned the ring had purchased “over $76 million” value of cryptoassets from OTC distributors and abroad exchanges.

These cash have been then offered “on behalf of abroad shoppers” on home exchanges, prosecutors alleged.