XRP Price Prediction as XRP Overtakes USDC Stablecoin in Market Rankings – $1 XRP Soon?

The XRP value has dropped by 2.5% in the present day, falling again to $0.5182 as the broader crypto market loses 1% previously 24 hours.

These losses come as cryptocurrencies throughout the board right a bit of after a really robust weekend, which noticed costs rise largely because of ballooning Bitcoin ETF volumes.

XRP is now up by 3% in every week however down by 9.5% within the final 30 days, though the altcoin nonetheless sits on 35% within the final 12 months.

And its actions over the weekend have enabled XRP to overhaul USDC by way of market cap, with this flippening possible to provide the altcoin extra momentum as we enter spring.

XRP Worth Prediction as XRP Overtakes USDC Stablecoin in Market Rankings – $1 XRP Quickly?

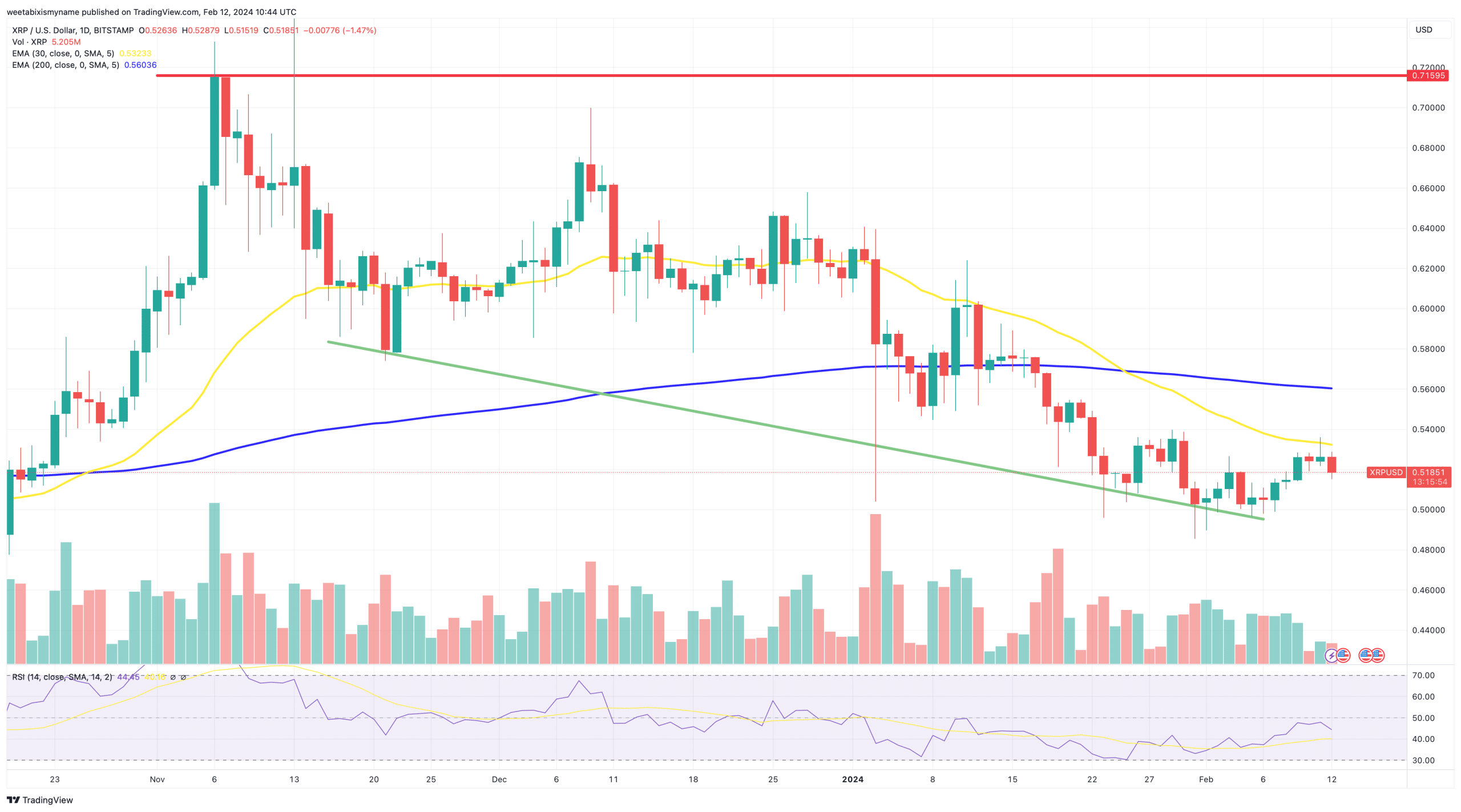

Even with the weekend’s rally, it nonetheless looks like XRP is struggling to construct up any actual momentum, with its indicators nonetheless in weakened positions.

Its 30-day common (yellow) fell under its 200-day (blue) in a ‘dying cross’ again in late January, and the shorter time period common continues to sink decrease in the present day.

Likewise, its relative energy index (purple) failed to achieve 50 over the weekend, and has now begun falling in direction of 40, in an indication of renewed promoting.

What’s significantly discouraging for XRP is that its help stage (inexperienced) has dropped persistently since late November, suggesting that additional losses might be within the offing earlier than stability returns.

And for coin within the top-ten available in the market by way of cap, its present 24-hour buying and selling quantity is worryingly low, at $800 million.

🚨 27,300,000 #XRP (14,444,647 USD) transferred from unknown pockets to #Bitstamp

— Whale Alert (@whale_alert) February 11, 2024

It does appear that almost all whales are nonetheless leaning extra in direction of promoting XRP relatively than shopping for it, at the very least judging by latest massive transfers.

As such, the XRP value might proceed to see losses within the subsequent few weeks, earlier than an more and more bullish market helps to select it up.

The long run image seems higher for XRP, nonetheless, with the long-running Ripple-SEC case prone to attain a full and last settlement by the summer season.

Such a settlement may contain a hefty monetary disgorgement for Ripple, with the SEC profitable a latest movement to compel that can see the cryptocurrency agency flip over its monetary statements.

🚨JUST IN: Decide Netburn has granted the SEC movement to compel in its entirety. pic.twitter.com/jam3dDuOnT

— JackTheRippler ©️ (@RippleXrpie) February 5, 2024

But plainly Ripple is ready to pay a giant advantageous, and that the corporate will have the ability to resume rising quickly afterwards.

It’ll carry XRP with it, with the coin doubtlessly on target to go $1 within the latter half of 2024.

New Meme Tokens with Potential for Market-Beating Good points

Many merchants might favor to research different tokens whereas XRP waits for larger rallies, with the market at present having fun with no scarcity of promising new alts.

One of the vital just lately launched and thrilling new altcoins is Smog (SMOG), a Solana-based meme token that listed on the Jupiter DEX aggregator final week

SMOG stays up by practically 2,000% since its preliminary itemizing a couple of days in the past, regardless of going via a bit of correction as earlier buyers cashed in some earnings.

Provided that so many Solana-based meme cash have pumped and fully dumped in latest months, it’s encouraging to see that SMOG has consolidated most of its early positive factors.

The principle cause for that is that the coin options an attention-grabbing airdrop system that incentivizes long-term holding.

That’s, it is going to maintain common airdrops that can present the most important rewards to these holders who’ve held essentially the most cash for the longest.

The token can have a max provide of 1.4 billion SMOG, 35% of which goes in direction of airdrops, with 50% going to advertising and 15% to liquidity.