Bitcoin price prediction this week 2024

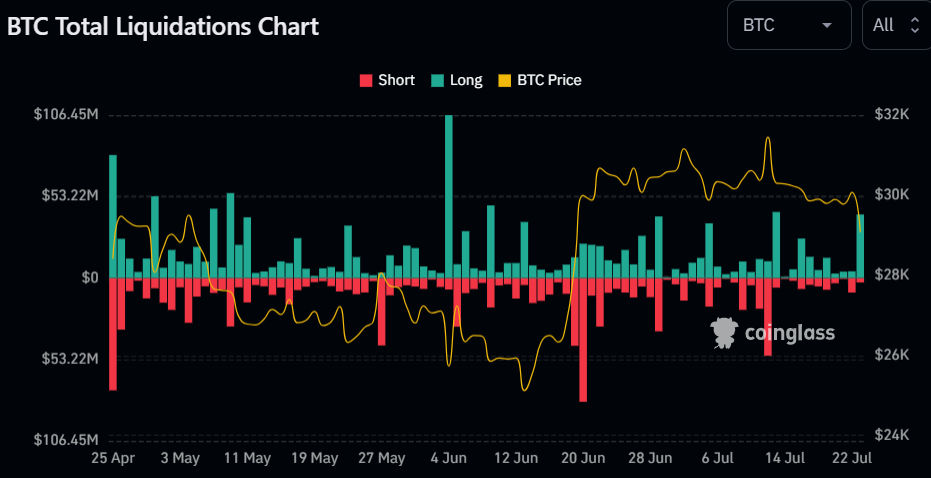

Leveraged lengthy positions within the bitcoin (BTC) futures market value $41.5 million have been liquidated on Monday, the second largest each day for lengthy liquidations to date this month, as per CoinGlass.com.

The spike in lengthy liquidations got here as bitcoin fell almost 3.5% to recent one-month lows underneath $29,000.

The BTC spot worth was final simply above $29,000, with crypto buyers/merchants locking in earnings after this 12 months’s spectacular efficiency amid an absence of recent optimistic catalysts to drive additional features within the bitcoin market.

Warning forward of this week’s US Federal Reserve coverage announcement (on Wednesday) and US Core PCE inflation (on Friday) is also enjoying a job within the draw back, as may recent unfavorable headlines referring to Binance, the world’s largest cryptocurrency trade.

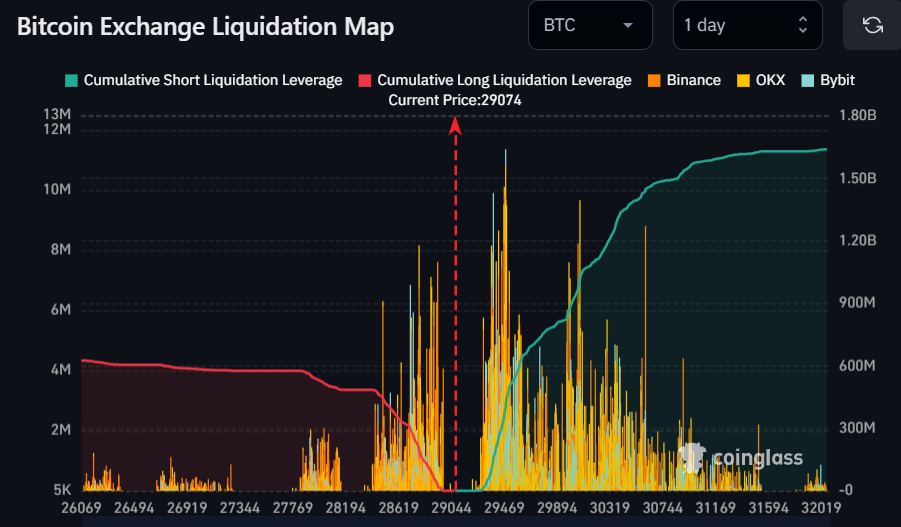

As per CoinGlass.com’s Bitcoin Change Liquidation Map, an additional wave of long-positions could be worn out if Bitcoin fell underneath $28,500.

As per CoinGlass.com’s graphic, leverages lengthy bitcoin positions value almost $500 million are susceptible to being stopped out earlier than BTC hits $28,400.

However the bears shouldn’t get too excited, as if bitcoin was to all of a sudden rise again into the mid-$29,000s, this might set off a short-squeeze, with leveraged short-positions value over $600 million susceptible to being stopped out if the BTC worth was to rise again to $29,600.

Right here’s The place Bitcoin (BTC) Might Go Subsequent

Regardless of bitcoin’s slip-up on Monday, buyers stay optimistic in regards to the cryptocurrency’s near-term trajectory.

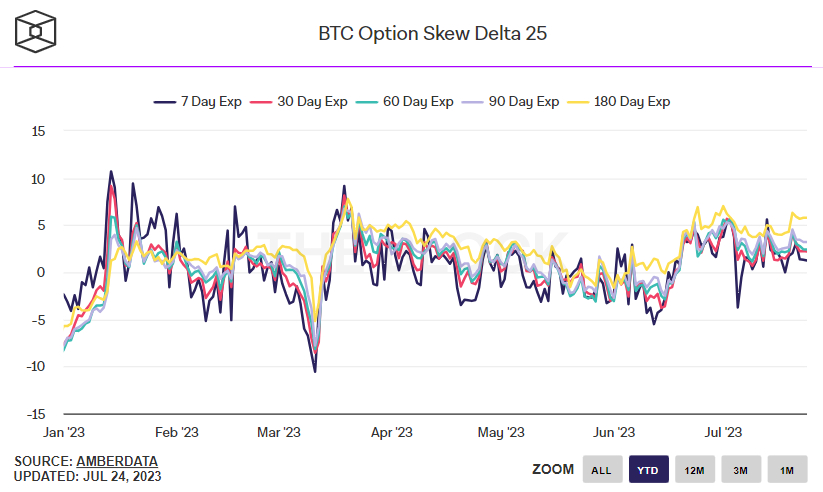

A minimum of, that’s the takeaway from taking a look at how bitcoin choices markets are priced.

The 25% delta skew of bitcoin choices expiring in seven days was final round 1.25, as per information introduced by The Block, suggesting that buyers are nonetheless paying a premium for bullish name choices expiring in seven days versus their equal bearish put choice counterparts.

The 25% delta skew of choices expiring in 30, 60, 90 and 180 days, in the meantime, are all sat at even increased ranges between 2 and 6, suggesting that choices buyers stay assured that bitcoin’s near-term trajectory stays broadly to the upside.

That view marries nicely with bitcoin’s technical outlook, which stays broadly optimistic.

Whereas the BTC worth is susceptible to slipping underneath its 50-Day Transferring Common simply above $29,000 this week, which might open the door to a check of assist within the $28,500 space within the type of the late-Could highs and 100DMA, bitcoin is approaching a powerful long-term resistance stage.

That’s the uptrend that started in late-2022 and has constantly supported the value motion to this point this 12 months.

With this week’s Fed assembly unlikely to push again an excessive amount of towards bets that this week’s hike would be the final of the cycle from the central financial institution, and with bitcoin nonetheless benefitting from the tailwind of elevated institutional curiosity in wake of final month’s spate of spot bitcoin ETF functions from Wall Avenue heavyweights, the argument for a breakout under this 12 months’s uptrend isn’t too sturdy proper now.

Any dip to the mid-$28,000s is prone to be considered as a pleasant dip shopping for alternative by many longer-term bitcoin bulls.